This essentially means that you can challenge the charge if you believe it’s fraudulent or an error. You may also contact the credit issuer over the phone, or you can always send a letter.As part of consumer protections, individuals can dispute charges put on debit cards and credit cards. Some have made the process easy by allowing customers to select individual transactions for disputes in their online account. If the issue still hasn't been resolved, contact your credit issuer. When you do contact the merchant, be sure you keep track of: It's easier for both you and the merchant to process a refund, after all. Many credit issuers ask you to contact the merchant first. If you feel you have a valid reason for requesting a chargeback, you have to start the process with the source of the problem. Goods or services weren't acceptable or delivered as agreed upon. Some examples of charge errors include your card being charged for the wrong amount, a subscription service charging you even though you canceled, math errors, the creditor failing to post a payment or return, or the creditor failing to send a bill to your current address (assuming you notified them 20 days before the closing date of your change of address). Federal law states that cardholders are not responsible for unauthorized charges greater than $50. Your credit card was stolen or charges appear from unauthorized users. Reasons to request a chargebackĭisputing charges on your credit card should be reserved for what the FTC describes as "billing errors." However, there are some instances where it doesn't make sense to request a refund from the merchant.

In situations like these, the Fair Credit Billing Act doesn't protect you, so a chargeback likely won't be approved. Note: If you have issues with the quality of a product or service you received from a business, try to resolve the issue directly with the business. This also applies if the creditor reports your account as delinquent while the disputed charge is being investigated.Īfter the investigation, a consumer will either keep the disputed amount or the amount will be deducted from their account a second time. Creditors are required to follow the settlement procedure exactly as outlined by the FTC, or they will not be able to collect the amount in dispute, even if it is a valid charge. The Federal Trade Commission (FTC) enforces rules for the FCBA. 10 days for the consumer to challenge the result of the investigation.Resolution within two billing cycles (but not more than 90 days).Explanation in writing if the investigation determines there was no billing error.Explanation in writing if your account has a mistake and what corrections were made.Acknowledgement by the creditor, in writing, that it received the complaint within 30 days.These also coincide with billing practices that creditors must follow. Under the FCBA, Stewart says, consumers have rights for open-end credit accounts, such as credit cards. "The law was designed to protect consumers from unjust billings to build customer confidence in credit processes," Stewart says.

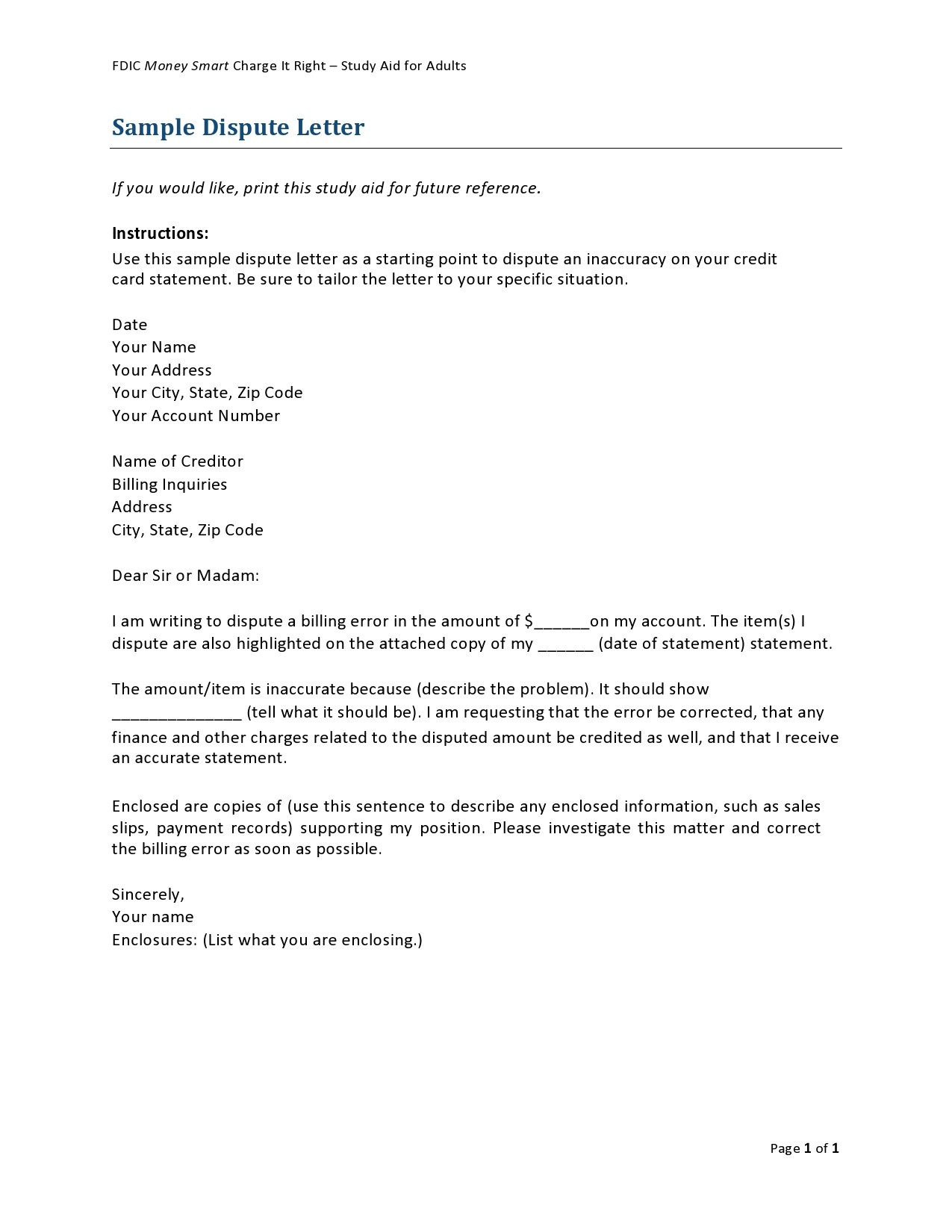

Mark Stewart, an in-house accountant at information site Step By Step Business, says the Fair Credit Billing Act (FCBA) of 1974 outlines the process that a merchant has to follow for chargebacks. The amount of the transaction is credited back to the consumer while the issuer and merchant investigate. It's issued after a consumer disputes a transaction and the card issuer determines the cardholder has a reasonable claim. What is a chargeback?Ī chargeback is the reversal of a charge on your credit. If your claim is reasonable, it can issue a chargeback to your card. In these cases, you may be able to dispute the charge with your credit card company. Or, perhaps you ordered a new outfit or a gift for someone else that never arrived from the other side of the world. It may have been from a business you've never heard of or maybe you were charged twice for the same transaction. Have you ever seen a charge on your credit card that didn't seem quite right? By clicking ‘Sign up’, you agree to receive marketing emails from InsiderĪs well as other partner offers and accept our

0 kommentar(er)

0 kommentar(er)